Repairing Your Credit

Categories: Credit Tips, Debt Management

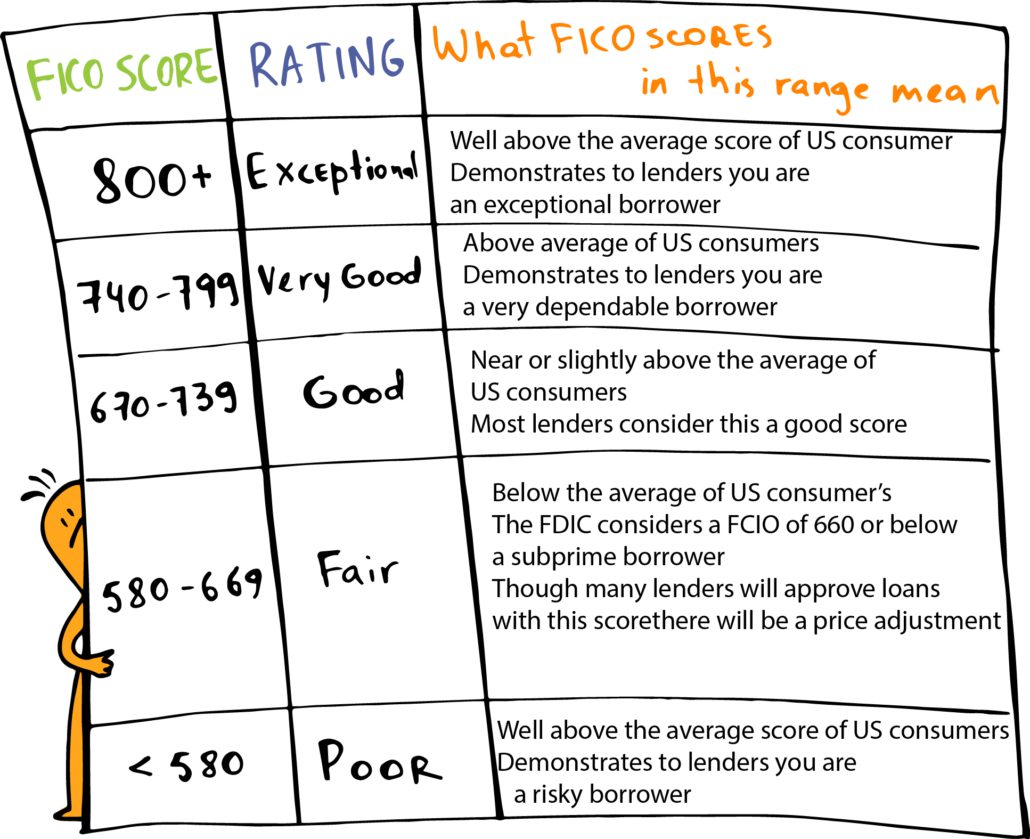

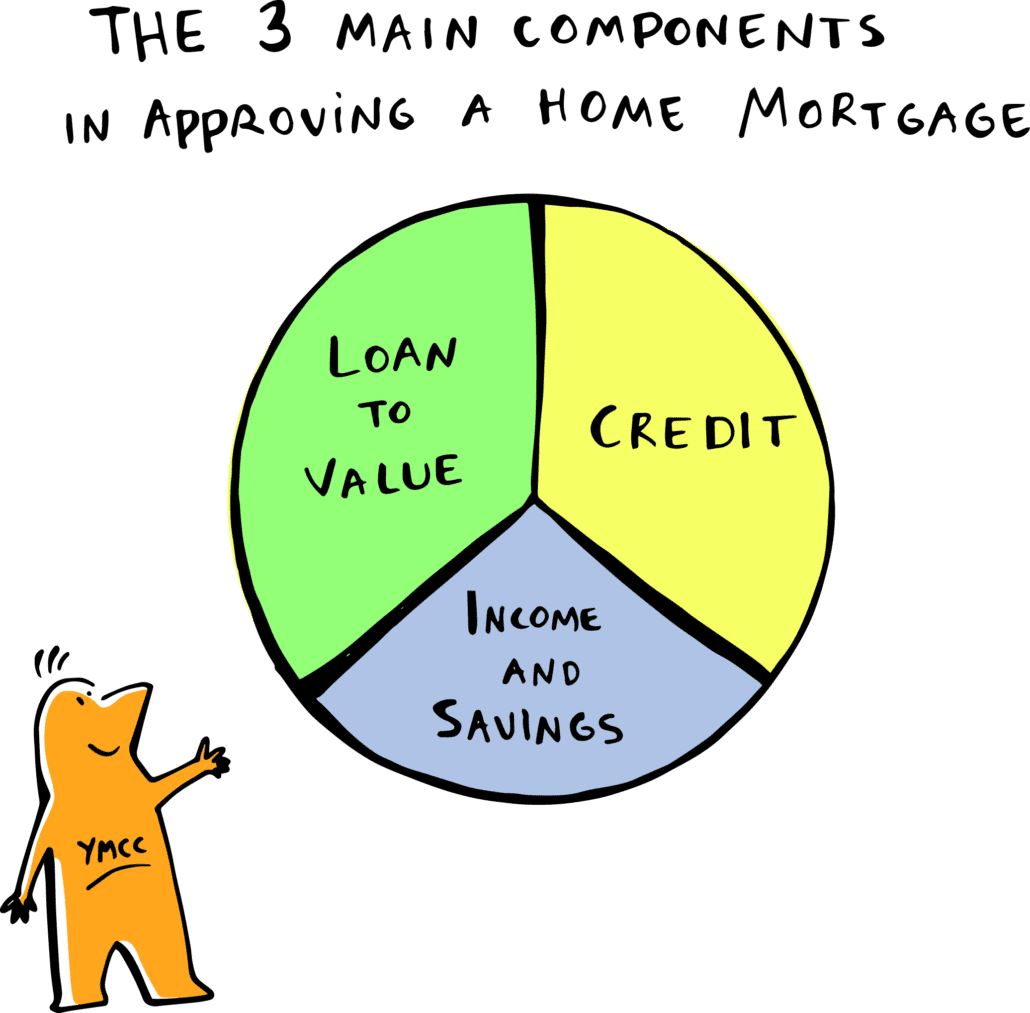

Repairing your credit might sound overwhelming, but it’s easier than you think. Credit scores aren’t set in stone, they’re like a report card you can improve over time. Whether you’re trying to buy your first rental property or just want better loan options, taking steps to repair your credit today can open doors tomorrow.

Example: Sarah had a score of 580 and kept getting stuck with high loan rates. After paying down a few small debts and disputing an error on her report, her score jumped to 640 in just a few months. That small change saved her thousands on her next loan.

The first step? Check your credit report. Look for mistakes, missed payments, or old debts you can pay off or negotiate. Even small wins, like reducing a credit card balance, can make a big difference.

Credit repair isn’t magic, but with focus and consistency, you can make real progress. Start small, stay steady, and watch how it changes your financial future.

Contact Us Today!

Do you need more information on repairing your credit? Contact us today to learn some tips that can help you level up quickly and easily!

Free Tools For You!

We also have free tools available! Accelerate Debt Payments Calculator to see which debt option is best for you!

Learn more!

Visit our YouTube channel to learn more about using debt instead of letting debt use you!

What is the 90-Day Challenge? Simply put, it’s when we pick an activity we love to do and stick with it for 30, 60, or 90 days.

What is the 90-Day Challenge? Simply put, it’s when we pick an activity we love to do and stick with it for 30, 60, or 90 days.