Most people waste thousands every year paying the banks too much.

In just one Smart With Debt Strategy Session, we’ll show you exactly how to cut your costs, simplify your payments, and pay off your debt faster.

If we can’t save you at least $1,500, you won’t be charged.

Why This Session Is Worth It

You’re not paying for “advice.”

You’re investing $150 for a custom money-saving plan that can easily return 10x to 50x in real savings.

Here’s what you’ll get:

- A full review of your current debt and credit situation

- A custom Smart With Debt plan showing how to save thousands in interest

- Clear comparisons between your current path vs. better debt options

- The confidence and clarity to make the right move the first time

If we can’t show you at least $1,500 in savings during your session, you don’t pay.

No gimmicks. No fine print. We don’t waste your time or ours.

How It Works

- Book your $150 Smart With Debt Strategy Session.

- Upload your debt details. (We’ll help you gather everything in minutes.)

- Meet 1-on-1 with a Smart With Debt Coach to see your numbers side by side.

- See exactly how much you can save by repositioning or consolidating your debt.

If we can’t find at least $1,500 in savings, you’ll walk away with your plan — and your money back.

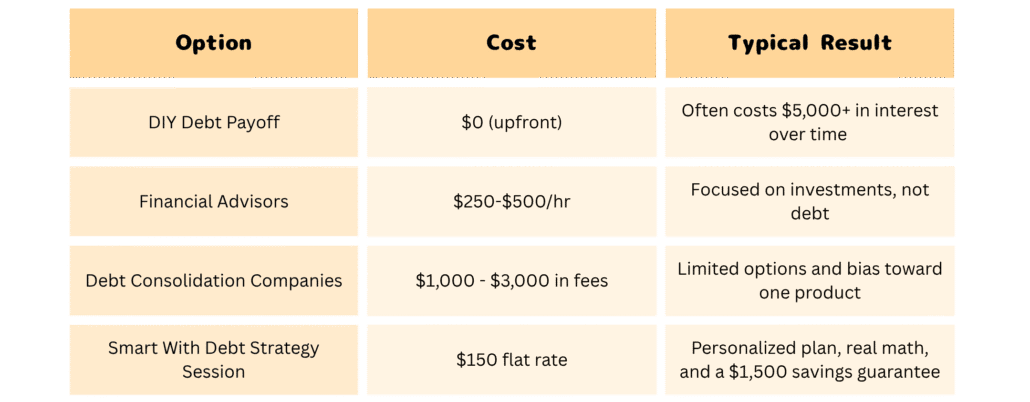

Compare Your Options

Why People Love It

I thought I had to just chip away at my cards for years. Mike showed me how to reposition first — saving me almost $9,000 in interest. The session paid for itself in minutes. – Sarah T.

The plan simplified everything. One payment instead of six, and we’re saving $400 a month. – Jason and Mel R.

Book Your $150 Smart With Debt Strategy Session — Risk-Free!

If we can’t show you at least $1,500 in real savings, you won’t pay.

This isn’t about taking on new debt — it’s about using the debt you already have smarter.

Stop overpaying the banks.

Start being smart with debt.

High-cost debt is like a leaky bucket—you keep pouring in money, but it keeps slipping away. At Smart with Debt, we help you plug the leaks and keep more of your money working for you.

WHAT WE DO

- Lower Your Cost of Debt: Stop letting banks win! We help you move from high-cost debt (like 24% credit cards) into smarter debt that saves you money now and in the future.

- Build a Plan for Your Future: Whether you’re 5 years or 15 years from retirement, we’ll guide you with tools and strategies to help you become debt free before retirement.

- Give You Freedom and Peace of Mind: No more juggling payments. No more stress. Just a clear path to a good life.

Why the Old Way Doesn’t Work

You’ve probably heard of the Dave Ramsey system. For some, it works, but for most Americans, it’s just too hard.

Think about it:

- You have to find extra money you don’t have.

- You might need to pick up side jobs.

- You’re expected to live on envelopes of cash.

-

Your walk of life is different from others.

On top of that, life is already stressful and busy. Most of us don’t need more daily chores just to try to beat the banks at their own game.

REPOSITION YOUR DEBT!

The fastest way to get ahead is simple: lower the cost of your debt first.

When you move balances into lower-interest debt, you instantly:

- Free up cash flow.

- Stress less about your daily spending.

- Pay down balances faster without working extra hours.

This isn’t about more sacrifice. It’s about smarter debt moves.

HERE’S THE BIG IDEA

If every American who qualified moved into *better debt* — debt that costs less upfront and over the long run — we’d have a stronger country. Families would get out of debt faster, and more people could finally enjoy financial freedom.

That’s why Smart with Debt exists: to give you real options that actually work in the real world.

Before you pick up another side hustle… before you beat yourself up about not budgeting harder… stop and ask yourself:

Is my debt positioned in the smartest way possible?

If not, that’s the first step. Reposition your debt. Lower your costs. Stress less. And start building the freedom you deserve.