Today we are going to discuss what credit score you need for a HELOC. To clarify, getting a Home Equity Line of Credit (HELOC) can help you tap into your home’s value. But what credit score do you need? Let’s break it down!

Understanding HELOC

A HELOC is like a credit card. However, instead of borrowing from a bank, you borrow against your home’s equity. You can use this money for repairs, investments, or anything else.

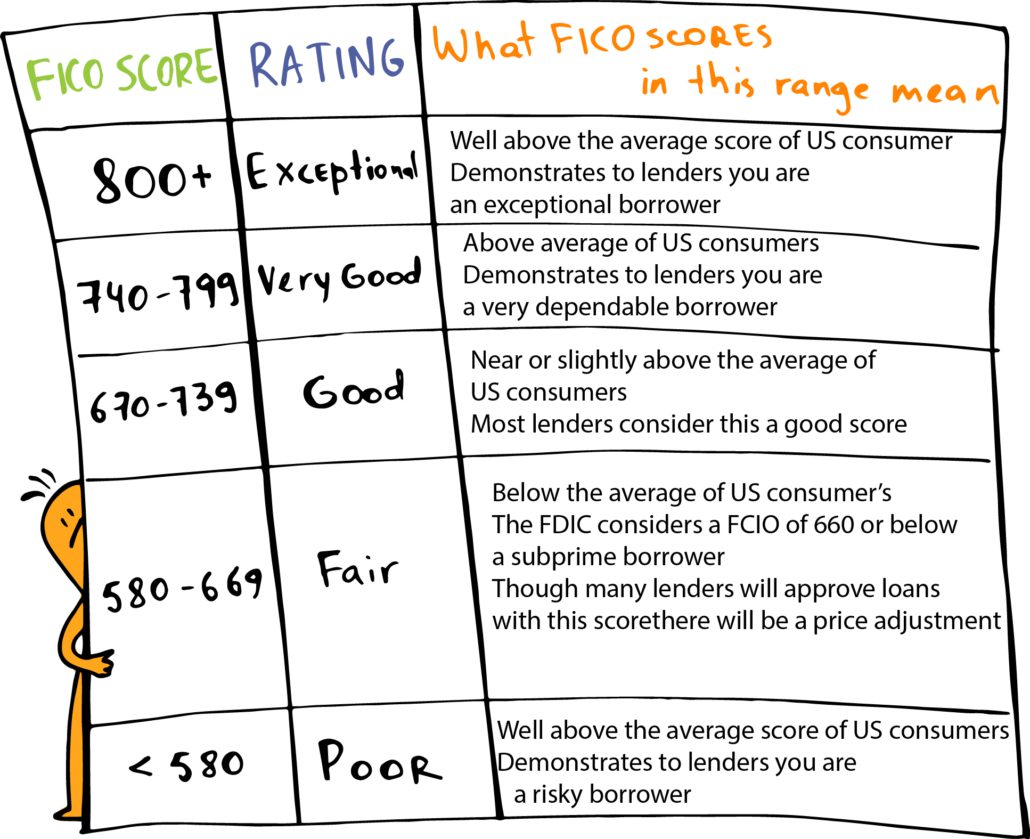

The Credit Score Sweet Spot

Good Credit Score

- Score Range: 700+

- Why It’s Good: Lenders see you as low risk.

- Benefits: Lower interest rates and better terms.

Fair Credit Score

- Score Range: 640-699

- Why It’s Okay: You’re still eligible, but terms might not be as good.

- Benefits: You can still get a HELOC, but interest rates may be higher.

Poor Credit Score

- Score Range: Below 640

- Why It’s Hard: Lenders see you as high risk.

- Options: It’s tough, but not impossible. You may need to improve your score first.

Tips to Boost Your Credit Score

- Pay Bills on Time: Consistency is key.

- Reduce Debt: Keep your credit card balances low.

- Check Your Credit Report: Look for mistakes and fix them.

- Avoid New Debt: Don’t open new credit lines if you don’t need to.

Other HELOC Requirements

Besides credit scores, lenders look at other things:

- Home Equity: How much is your home worth compared to your mortgage?

- Income: Do you have a steady income?

- Debt-to-Income Ratio: How much debt do you have compared to your income?

Why Your Credit Score Matters

A good credit score shows lenders that you’re reliable. It can make the process of getting a HELOC smoother and cheaper.

Conclusion

Getting a HELOC depends on more than just your credit score, however, having a good score helps. Remember to keep an eye on your credit and make improvements where you can. In doing so, you’ll be in a better position to get the HELOC you need.

Contact Us Today!

Do you need help navigating your financial future? Contact us today!

What is the 90-Day Challenge? Simply put, it’s when we pick an activity we love to do and stick with it for 30, 60, or 90 days.

What is the 90-Day Challenge? Simply put, it’s when we pick an activity we love to do and stick with it for 30, 60, or 90 days.