Tag Archive for: Mortgage help

One of the biggest credit pitfalls people fall into is when they have a high balance on a small credit card. For example:

You have a $500 credit card and charge $400 on it. When creditors see you’re using 80% of your available credit, they mark you as HIGH risk. Now, let’s say you have a $1,000 credit card and charge $400 to it. Guess what? You’re no longer a risk because you’re only using 40% of your credit instead of 80%. To creditors, this means you’re a responsible, savvy, frugal adult.

Go you!

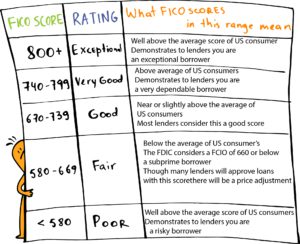

What’s a Good Credit Score?

Categories: Credit Resources

What does a good, solid, lender-friendly credit score look like?

In the mortgage industry, lenders like to see scores above 760. Anything under 660 could get a Simon Cowell-like rejection. Okay, maybe not that harsh, but still. You’ll risk hearing “No” more than “Yes” if your credit score is too low.

Do you know what your credit score is? To find out for free, go to AnnualCreditReport.com. You can also pay to get your FICO scores by going to MyFico.com.

To learn more about credit, and how you can get a mortgage when the bank says no, go to smartwithdebt.com.

Before you think about buying your dream home, check out this article from Business Insider.