Tag Archive for: Fix credit

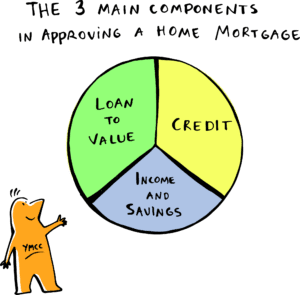

Do you know what the mortgage approval process looks like? Well, here’s a snapshot:

The mortgage approval process is determined by three main factors:

- Credit score.

- Income/savings.

- How much money you put down on a house (or the loan-to-value).

The higher each factor is, the easier it is to get a loan. Why? Because there’s little to no risk for a mortgage company. You’ve proven you’re financially stable.

What if one of these three factors aren’t good? Well, you need to find a way to balance things out.

To learn more credit strategies, and how you can get a mortgage when the bank says no, go to smartwithdebt.com.

Credit Matters More Than Ever

Categories: Credit Resources

Credit has mattered for many years, but now it matters more than ever. Find out why with this article from CSR!